How to Finance an ATM Business: A Step-by-Step Guide”

Entrepreneurs constantly look for profitable ventures to generate steady income, and the ATM business is one such opportunity. With more people relying on cash access outside traditional banks, automated teller machines (ATMs) are essential to everyday financial transactions. And while it’s a lucrative industry, it requires substantial investment to set up and scale effectively.

Financing is often the backbone of launching an ATM business, enabling you to cover upfront costs and maintain operations efficiently. This guide will break down the costs involved, explore financing options, and walk you through the steps to secure funding for your ATM business. By the end, you’ll have actionable insights to confidently plan your finances and take charge of your venture.

Understanding the Costs of an ATM Business

Before discussing financing, it’s crucial to understand the costs involved in starting and running an ATM business. These expenses typically fall into four categories:

1. Startup Costs

- ATM Machines: Purchasing an ATM can cost anywhere from $2,000 to $10,000, depending on the type and features you select. Advanced models with touchscreen interfaces and banknote processing can cost more.

- Installation and Setup: Depending on the provider, you may need to pay for installation, terminal fees, and any initial software setup.

2. Operational Costs

- Cash Loading and Maintenance: Regularly loading machines with cash and ensuring they perform optimally requires a financial outlay.

- Software Upgrades and Repairs: Many ATM operators face recurring costs for system updates and repairs to keep their machines compliant with banking regulations.

3. Location Costs

- Rent or Revenue-Sharing Agreements: Depending on where you place your ATMs, you might pay rent for the space or share the revenue with business owners hosting your machines.

4. Compliance and Licensing Fees

- Permits and Insurance: Legal permits and liability insurance are necessary to comply with regulations and protect your business.

- Other Fees: These may include banking network integration costs or municipal fees.

Why Financing is Necessary for an ATM Business

High upfront costs are among the greatest barriers for new entrepreneurs in the ATM industry. This is where financing can be a game-changer. Here’s why it matters:

- Overcome Initial Costs: Financing lets you acquire machines and handle initial expenses without depleting personal savings.

- Scale Quickly: With proper funding, you can deploy several machines at once, setting you up for higher returns.

- Manage Operational Expenses: Leveraging financing ensures you have enough cash flow to maintain and service your machines.

Financing Options for an ATM Business

You have a variety of financing options to choose from, depending on your business goals, credit history, and financial situation. Here’s an overview of some of the most common:

1. Personal Savings

Using personal funds allows you to avoid debt, but it poses a significant risk if you run into unexpected costs. While self-funding can save you interest payments, ensure you maintain enough savings for emergencies.

2. Bank Loans

Traditional business loans are an excellent option for entrepreneurs with strong credit. With competitive interest rates, banks provide funding for purchasing ATMs and covering initial setup costs. Be prepared with a solid business plan to improve your loan approval chances.

3. Small Business Administration (SBA) Loans

SBA loans are government-backed and favorable for small business owners. They offer lower interest rates, flexible terms, and greater accessibility compared to traditional bank loans.

4. Equipment Financing

This type of financing is tailored specifically for purchasing equipment like ATMs. You’ll make regular payments while using the equipment to generate revenue.

5. Leasing Options

Instead of purchasing machines outright, entrepreneurs can lease ATMs. Leasing reduces upfront costs and is ideal for those who want flexibility without long-term commitments.

6. Investors or Partnerships

Collaborating with investors can help you share startup costs and risks. Alternatively, explore partnerships with retail businesses where you install your ATMs.

7. Business Credit Cards

Credit cards can cover smaller startup expenses. However, it’s crucial to manage balance payments carefully to avoid high interest.

8. Alternative Financing

Crowdfunding and peer-to-peer lending platforms are creative alternatives that help raise funds. Merchant cash advances are another option but should be considered a last resort due to high repayment costs.

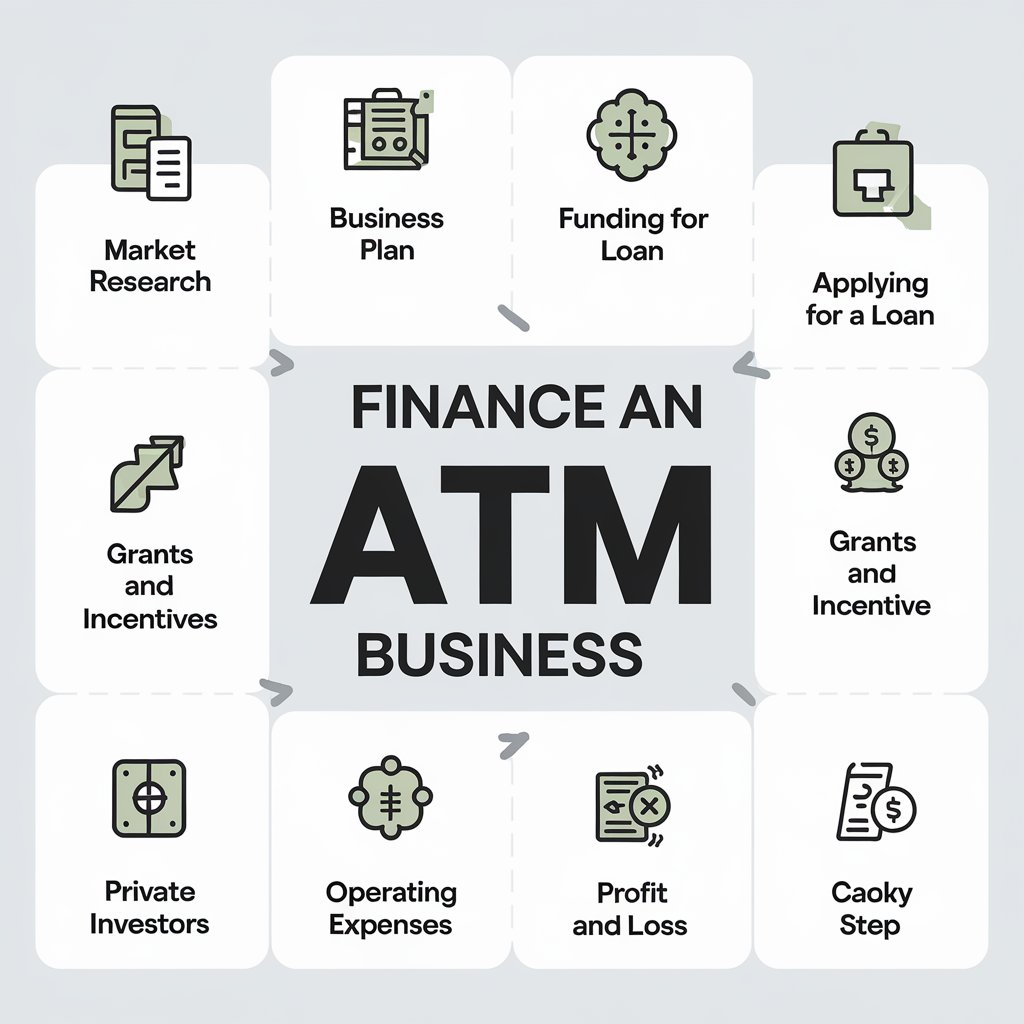

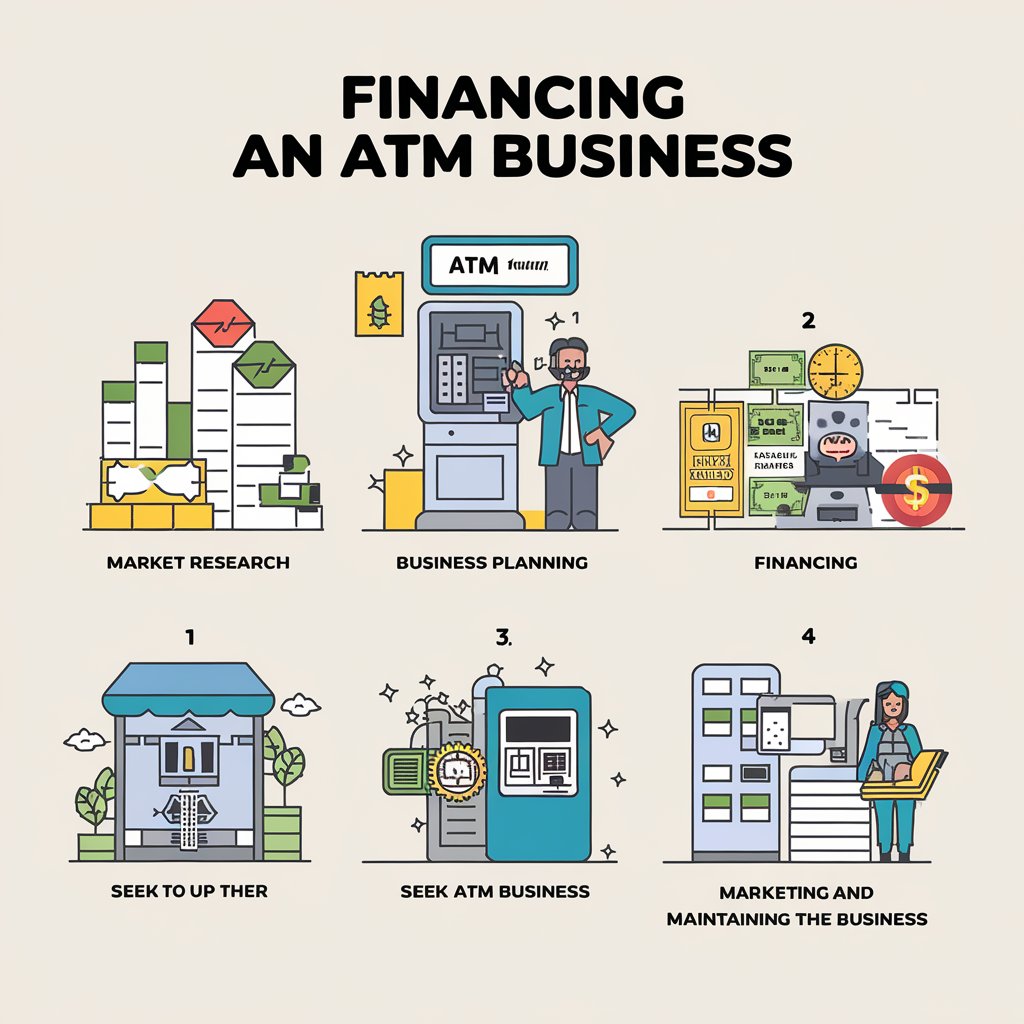

Steps to Secure Financing for an ATM Business

Financing your ATM business may seem daunting, but breaking it into steps simplifies the process:

Step 1: Develop a Business Plan

Highlight your target locations, marketing strategy, and financial projections. A detailed plan bolsters your credibility with lenders.

Step 2: Research Financing Options

Compare loans, leasing programs, and alternative financing sources. Weigh their interest rates, terms, and repayment schedules.

Step 3: Prepare Documentation

Gather necessary documents, such as your credit history, proof of income, tax returns, and financial statements.

Step 4: Apply for Financing

Submit applications to suitable lenders including banks, leasing companies, or SBA programs.

Step 5: Review Terms and Conditions

Pay close attention to interest rates, repayment timelines, and potential fees before signing any agreements.

Maximizing ROI with Effective Financing

Securing financing is only the first step. To get the greatest return on your investment, you’ll need strategies for maximizing profitability:

- Prioritize High-Traffic Areas: Choose locations with high foot traffic (gas stations, malls, or convenience stores) to ensure maximum usage.

- Negotiate Revenue Agreements: Work out favorable terms with business owners hosting your machines.

- Minimize Downtime: Monitor cash levels and provide routine machine servicing.

- Expand Strategically: Reinvest your profits into additional ATMs once revenue stabilizes.

Common Mistakes to Avoid in Financing an ATM Business

Steer clear of these pitfalls to ensure your business remains financially healthy:

- Over-Leveraging: Avoid taking on excessive debt that could strain your cash flow.

- Ignoring Hidden Costs: Budget for software updates, maintenance, and unforeseen expenses.

- Choosing the Wrong Financing: Evaluate all options to avoid unnecessarily high interest rates.

- Lack of Planning: Understand your cash flow needs to prevent operational disruptions.

Case Studies: Successful Financing Stories

Case 1

An entrepreneur used equipment financing to deploy five ATMs at prime locations. Within two years, they scaled up to 20 machines and achieved substantial ROI.

Case 2

A small business owner secured an SBA loan to fund initial expenses, focusing on compliance and boosting scalability.

Case 3

A retailer co-financed ATMs with an independent operator, sharing profits and benefiting from additional store traffic.

FAQs About Financing an ATM Business

How much money do I need to start an ATM business?

Startup costs vary but typically range from $3,000 to $10,000 per machine.

Can I finance my ATM business with bad credit?

Yes, alternative financing options like partnerships or leasing may work if traditional loans aren’t an option.

What is the typical ROI for an ATM business?

With the right locations, many operators see an annual ROI of 20% to 40%.

Are there grants available for starting an ATM business?

Some states offer grants for small business initiatives. Check local resources for opportunities.

Start Your Path to ATM Success Today

Financing is a critical part of launching and scaling a successful ATM business. By understanding costs, exploring your options, and planning effectively, you can build a profitable enterprise that generates steady income.

[Begin planning your ATM business today. Explore financing options that work for you and turn your entrepreneurial goals into reality.]

Post Comment